You are currently browsing the tag archive for the ‘Health’ tag.

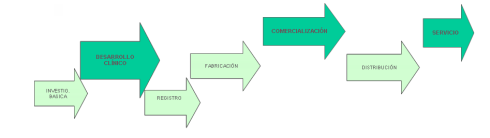

Con la aprobación de la Ley de 1984, comúnmente conocida como Hatch-Waxman, la industria de genéricos comenzó a florecer ya que permitió la creación de solicitudes abreviadas de fármacos nuevos o ANDA, que no requieren datos pre-clínicos y clínicos, sino simplemente la prueba de bioequivalencia del original aprobado, lo que resulta más asequible. Además, la ley permite a las empresas de genéricos trabajar en los estudios de bioequivalencia mientras el original está todavía protegido por patente, lo que acelera sus tiempos de desarrollo. Esta situación inicial, ponía el énfasis en el eslabón de registro y fabricación en su cadena de valor.

Mientras que las compañías farmacéuticas innovadoras sienten cada día la presión y recortes, las compañías de genéricos están teniendo sus propios problemas: moléculas que hace unos años podían conseguir el 25% del precio original para el genérico, ahora logran sólo alrededor del 5%. Debido a esta evolución del panorama, algunas compañías de genéricos están reestructurando sus modelos de negocio y algunos fabricantes están reinventando su cartera de productos a través de una estrategia de re-innovación: nuevas plataformas tecnológicas y nuevas configuraciones para facilitar el cumplimiento del paciente y aumentar su calidad de vida.

Super-genéricos, biosimilares y versiones superiores con valor añadido son algunas de las alternativas de nuevos productos resultantes de esta evolución innovadora. Así, la biotecnología, las nanociencias y la nanotecnología son áreas estratégicas para su desarrollo científico y comercial

En concreto, los biosimilares, -versiones genéricas de los medicamentos biológicos-, han sido calificados como el “Santo Grial” para las compañías de genéricos. Mientras que replicar exactamente una molécula pequeña es bastante simple, las pequeñas diferencias “técnicas” pueden conducir a grandes diferencias en la calidad, eficacia y biodisponibilidad de un producto biológico.

Para profundizar en el modelo de re-innovación, algunas empresas de genéricos intentan conseguir ventajas competitivas, ya sea mejorando los atributos de productos existentes, mediante la sustitución de componentes nuevos, remodelando su configuración o con el uso de nuevas plataformas tecnológicas para producir nuevos productos “innovadores”.

Un producto farmacéutico desarrollado y fabricado con menos excipientes que el original mientras se mantiene el rendimiento terapéutico, podría considerarse como una entidad terapéutica mejorada, ya que reduce los costos generales de fabricación que podrían contribuir a reducir el gasto sanitario.

Ejemplos de vuelta a la innovación por la industria genérica se observan en el diseño de fármacos, formulación, procesos de fabricación, etc. y que se remontan a las primeras etapas del ciclo de desarrollo del producto. Es decir, se apuesta por los eslabones de la Cadena de Valor de Investigación y Desarrollo: Clínico y Galénico. Algunos ejemplos son: Abraxane, super genérico de Taxol, Subacap, versión mejorada del Itraconazol o la aplicación de tecnología de nanopartículas para abordar la administración de compuestos poco solubles como el Candesartán.

Los Super-genéricos son productos de nano y micro-tamaño con sistemas de administración de fármacos que mejoran los principios activos que se comercializaban anteriormente con otra formulación. No son bioequivalentes en el sentido estricto de la industria; no son genéricos, pero la modificación de la liberación de fármacos que tienen una vida media corta evita los picos altos en plasma, reduce las fluctuaciones en los niveles y permite un consumo de una vez al día, que puede optimizar la terapia.

La industria farmacéutica de genéricos se está reconvirtiendo hacia un formato menos genérico, pero más innovador, y muchos laboratorios tienen la capacidad de re-innovar con nuevas alianzas que pueden proporcionar los recursos financieros necesarios para el know-how técnico y de marketing. Obviamente, en estos casos de re-innovación, el eslabón de la Comercialización cobra un nuevo significado –de nuevo-, tanto en ventas como en marketing.

Publicado en Correo Farmacéutico, Abril 2013

The number of Spaniards who work, directly or indirectly, in the Health Sector exceeds one million. Some authors even venture two million, counting more indirect employees. Surpassing the figure of one million is simple if we consider not only medical and pharmaceutical care, but related segments like elderly patients care, cosmetics, nutrition or animal health.

The number of Spaniards who work, directly or indirectly, in the Health Sector exceeds one million. Some authors even venture two million, counting more indirect employees. Surpassing the figure of one million is simple if we consider not only medical and pharmaceutical care, but related segments like elderly patients care, cosmetics, nutrition or animal health.

An increase in the next decades can be foreseen, given the continuous demand of health on the part of the population. The key of this increase in Spain is that, -unlike what happened in previous generations-, more and more citizens are willing to pay from their own pocket a complement for some treatments, on top of the contribution via taxes. Every day we see a growing tendency to use dentists, paediatricians, ophthalmologists, gynaecologists, hearing aids, plastic surgeons, etc. All this growth is translated into an increase of the employment in the sector.

A differential characteristic of this personnel working in Health is the professional qualification, that is remarkable with respect to other sectors, arriving to have almost 600,000 registered professionals. Farmaindustria esteems that more of 40% of the personnel employed by the pharmaceutical industry has a specific qualification, and there, University degrees are more than a half.

Employment in this sector shares three vectors that condition their careers: 1) permanent innovation that forces to a continuing update of knowledge, 2) specific legislation and regulatory subjects – a formidable challenge for outsiders, and 3) the role of the prescriber, -not in all cases the doctor-.

In Spain the biggest employer in health is the public sector. However, that no longer consolidates numbers in which was denominated INSALUD, since from the beginning of the century our 17 autonomous communities (CCAA) have HR competences transferred and count on his own personnel (SAS, ICS, Osakidetza, Sermas,etc.) and to collect homogeneous data is now a titanic task. As a last consolidated reference, -at the end of year 2000-, INSALUD counted 29,310 physicians, 68,225 non-physicians and 38,195 non-sanitary, totalling 135,730 people. It seems likely that in these ten years the CCAA will be using more personnel, although the total figure is now imprecise.

The data of registered sanitary professionals by theINE in year 2007 offers another valuable reference with nearly 600,000 professional registered, although some could be professionally non-active.

|

Total |

|||

| Doctors |

208.098 |

||

| ATS and DUE (Nurses) |

243.000 |

||

| Pharmacists |

61.300 |

||

| Veterinarians |

27.594 |

||

| Physiotherapy |

28.720 |

||

| Odonto and Estom. |

24.515 |

||

| Podiatry |

4.909 |

||

| Total: |

598.136 |

Source: INE. Registered health professionals in 2.007

On another segment, the Pharmaceutical Industry employs more than 39,100 people according to Farmaindustria data of 2007. A tendency observed is the encouraging growth of R&D activities , employing 4,616 professionals almost a 12% of the total. In traditional Pharmaceuticals growth is coming from hospital specialties like Oncology, Transplant, orphan drugs, etc, with reductions now widespread in Primary Care, and therapeutic areas already well covered like Digestive, Ostheoarticular, Respiratory, etc.

Following from my recent post Recruitment differences in Health and Science last week I was invited to talk in Barcelona at the Personal España fair and exhibition about the differences that specialist recruiters have compared to generalists.

Following from my recent post Recruitment differences in Health and Science last week I was invited to talk in Barcelona at the Personal España fair and exhibition about the differences that specialist recruiters have compared to generalists.

Basically I can identify three characteristics: consultants must have previous experience in the field, they understand and speak the language of clients and candidates and they also keep updated on the latest developments in the various segments of the industry. In short, both parts perceive that the consultant is “one of them”. This is not unique to Life Sciences; it happens the same with Finance, IT, etc.

In parallel, I was preparing a .ppt (with the help of Javier de Inocencio) presentation for the Life Sciences practice of my network Penrhyn International and had to summarize the advantages of these characteristics: Penrhyn-life-sciences-practice-presentation

1) A specialist recruiter can enrich the briefing with the client and even offer some benchmarking from the very beginning of the search.

2) Knows what target-companies to approach and whose not: it is more efficient. Complementary to this, can identify “lateral candidates”, the non obvious, sometimes temporarily in Consultancy, Services, another country, another function, etc.

3) Gets spontaneous referencing that is extremely valuable along the project.

4) Can focus the personal interviews on real key issues, avoiding generalizations and clichés.

5) When the practice consultants have complementary backgrounds and are based in different locations, they can also offer a true “global view” of the sector.

What makes Biosciences executives different from other economy segments? It is commonly argued that it is a different industry with a certain endogamy seen in their companies and some functions. Apart from the unpredictability associated with basic research, a basic difference is that Biosciences project a global approach from the very moment that a molecule is identified. Here are three others:

What makes Biosciences executives different from other economy segments? It is commonly argued that it is a different industry with a certain endogamy seen in their companies and some functions. Apart from the unpredictability associated with basic research, a basic difference is that Biosciences project a global approach from the very moment that a molecule is identified. Here are three others:

* Permanent Innovation. With a clear science-and-research culture, innovation is embedding in this sector DNA. The most successful corporations are the ones with a clear commitment to R&D. An average R&D investment of 15%, that may go as high as 20% is difficult to beat for most industries, except sometimes IT or Telecom. Successful executives must get used to project management and drug development in many innovative disciplines such as Molecular Biology, Genetics, Nanotechnology, Proteomics, etc. Any professional headhunter knows that Biosciences CEO’s and VP’s must not be sought from mature or “comfortable” sectors .

* Regulatory Affairs. A challenge for executives coming from other sectors is market access. Price is not free in most countries, packaging cannot be changed without notifying the health authorities, distribution channels are well established with the role of Hospitals and Pharmacies also regulated. Moreover, promotional claims or DTC advertising must pass previous approval in almost every country, particularly for reimbursed products. Business Development deals require a quick adapting to new segments with a strong focus on health economics, outcomes and reimbursement.

* The role of prescription. When the ultimate customer, the patient, is often remote and not in direct contact with the innovator, a pharmaceutical o biomedical product requires the professional advice of a prescriber. This works in cascades: international opinion leaders(OL’s), national OL’s and local OL’s. Nowadays, specialists -in a clear shift from primary care- again prescribe the most innovative and attractive products. And the number of stakeholders has grown in recent times, including now clinical boards assessing new drugs, patients associations, medical societies and -in countries like Spain- autonomous communities authorities, etc.

The advent of personalized medicine will mean more specialist drugs for smaller groups of patients and a shift back to science vs. marketing, -that was so effective in the me-too and blockbuster era-. Executives used to work with that type of products need to reset to the new targeted-only business model and the recruiters involved in these types of searches must have the “helicopter view” necessary to differentiate segments and cultures, on top of speaking the language of the industry.